Invest in Our Community

A New Way to Support Our Valley's Future

Project Olympic isn’t just about building structures; it’s about building community.

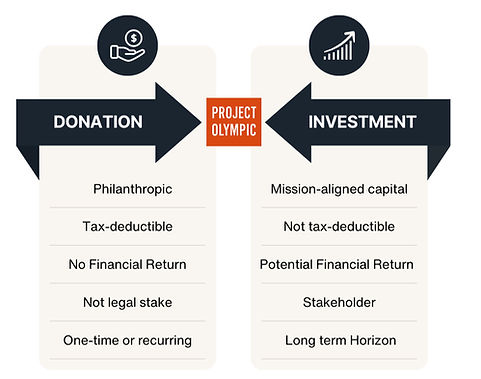

We are exploring potential hybrid capital structures that combine a traditional 501(c)(3) nonprofit with for-profit investment vehicles. This innovative model allows community members to invest—rather than simply donate—toward Project Olympic.

In doing so, investors can earn a return while contributing directly to a sustainable and inclusive future for Olympic Valley.

Combining Mission and Financial Sustainability

Our hybrid approach strikes a balance between philanthropy and investment. By incorporating both nonprofit and for-profit structures, we open doors for broader community involvement and long-term project viability.

-

Empowers local stakeholders to invest, not just donate

-

Attracts mission-aligned capital alongside philanthropic grants

-

Provides flexible capital-raising options tailored to community needs

-

Protects community ownership and preserves Olympic Valley's legacy

-

Follows successful models from other community-focused developments

FAQs

What kind of returns should investors expect?

Investors should expect below-market financial returns. Our focus is on mission-aligned, patient capital that prioritizes long-term community benefit over short-term financial gain. Specific return structures depend on the investment vehicle used and will be provided in the Offering Memorandum.

How does investing in a community project differ from donating?

Investing provides the opportunity to potentially earn financial returns while contributing to community development, whereas donating is purely philanthropic with no financial return.

What safeguards are in place to protect community values?

We will incorporate mission lock provisions, public benefit reporting, community oversight, and legal frameworks such as a Public Benefit LLCs or Public Benefit Corporation to ensure the community’s interests are prioritized over profit.

Who oversees and manages the investment structure?

It will be overseen and managed by a 501(c)(3) entity, along with an independent board of directors and professional advisors to ensure compliance with legal, financial, and community guidelines.

Can investments be structured for retirement or family trusts?

Yes, depending on the final structure selected, investment opportunities may be open to retirement accounts, family trusts, and other long-term financial vehicles. We recommend consulting with a financial advisor for specifics, after receiving the Offering Memorandum.

We Want

Your Input

We believe in building this future together. That’s why we are inviting input from community members and local businesses. If you’re curious about how the structures work or want to explore becoming an investor, please complete the form below.